One of the common reason many people get into credit card trap is they underestimate Power of Minimum Amount Due Credit Card Trap. Before going forward I will share in brief What is Minimum Amount Due on Credit Card?

What is Minimum Amount Due on Credit Card?

Minimum Amount Due is minimum payment to be made by credit card holder to avoid penalties on amount due. It is generally calculated as 5% of your credit card bill Plus any EMI due for the billing cycle. Also some company have policy that minimum amount due will be minimum 5% of bill or Rs.100/200 etc.

Example 1: Say Mr. Mahek had spent Rs.100000 in last month. So Minimum Amount Due will be 5% of Rs.100000. i.e. Rs.5000.

Example 2: Say Mr. Mahek had spent Rs.100000 in last month and also have an on going EMI on Credit Card. (EMI amount is say Rs.3000). So Minimum Amount Due will be 5% of Rs.100000 Plus Rs.3000. i.e. Rs.8000.

Now as we are through with Minimum Amount Due (MAD) and it’s example let’s go to point why I called Minimum Amount Due as MAD.

We will again continue with Example 1. Let consider your credit card company charge you interest @3.5% p.m. (this range is common in India).

As you can see from above table out of Rs.5000 paid on as Minimum Amount Due only Rs.870 could be adjusted against outstanding amount. So if you keep paying MAD maximum amount will be adjusted against Interest & GST. To make it more clear for you let assume Mr. Mahek decide to pay minimum amount due for 12 months. And let see how much amount will be paid in a year and what will be outstanding amount after 12 months

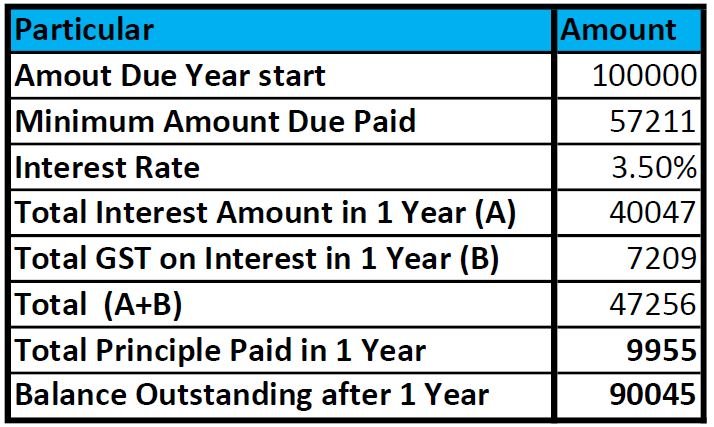

As you can see from above example Rs. 57211 will be be paid by us in Total for Minimum Amount Due on Credit. Our of Which only 9955 will be adjusted against principle. Hence after 12 months Outstanding Amount Will be little above Rs.90000.

Solution to get out of Minimum Amount Due Trap

My Suggestion would be to take a personal loan and pay off the complete amount. And pay EMI for Personal loan or convert the higher transaction in EMI before bill generation.

Benefits

- The reason I am suggesting it to pay by personal loan because the are much cheaper than the interest charged on credit card. A person can get personal loan in range of 10% to 24% easily. If a person have a good enough credit score then the rate will be less than 15%.

- If you continue paying minimum amount due every month it have a negative impact on you credit score. (CIBIL, Crif Score)

Conclusion:

So it is advisable that if you can’t pay the outstanding amount on your credit card for longer period then instead of going for Minimum Amount Due you can opt for some loan and lower rate or convert to EMI (large transaction) as it will help you to Save Money and Improve your credit score. My YouTube Video on Minimum Amount Due on Credit Card

Video on Minimum Amount Due Trap

Do share if you have paid Minimum Amount Due..